In partnership with

Good morning ☀️

Today, Founder Institute is celebrating the graduation of its 10th cohort with a fireside chat themed “Scaling with Resilience.”

Our folks on the inside have told us that this event will feature insights from organizational leadership experts, founders of venture-backed startups, and experienced investors. It’s also a fantastic opportunity to connect with the Founder Institute Lagos ecosystem, including FI’s network of startups, alumni, partners, investors, and mentors.

RSVP here.

IoT

Citidata’s big bet on edge data centres in Nigeria

Nigeria’s data centre market is a study in contrasts. On one hand, the demand for data centre solutions is growing across different big data businesses, such as government entities and banks, which are required to store data locally. On the other hand, the country still only has 14 data centres compared to South Africa’s 39, the most on the continent.

Generally, Africa still has much catching up to do with other continents. South Africa can count itself lucky as bigger players like Amazon Web Services are committing to developing data centres. For Nigeria, Citidata Centre is one of the companies trying to fill this demand gap.

Its plan? Build six new Tier III edge data centres in Ogun State and Lagos State by 2027. The company’s flagship centre in Ogun state, which launched in July 2024 with a 30-rack capacity, is set to expand to 80 racks. Five more centres will be located across key business hubs like Ajao Estate, Surulere, Lagos Island, Lekki, and Victoria Island.

Edge data centres offer a practical solution for Nigeria’s market where large-scale infrastructure is still too costly as businesses—even banks are trying to cut costs on infrastructure.

By focusing on local assembly and partnerships, Citidata aims to keep costs down. As Citidata CEO Andie Moyan noted, “agility” and “cost-effectiveness” are key in this environment. When the options are cheaper and offer better incentives for big businesses to jump ships, they’ll make the switch.

As Nigeria’s demand for internet connectivity and data storage grows, companies like Citidata are positioning themselves to play a role in closing the infrastructure gap. Whether this strategy can improve Nigeria’s data centre game remains to be seen, but one thing is clear: the race to meet demand is only getting started.

Read Frank Eleanya’s article.

Read Moniepoint’s Case Study on Funding Women

After losing their mother, Azeezat and her siblings struggled to keep Olaiya Foods afloat. Now, with Moniepoint, they’re transforming Nigeria’s local buka scene. Click here for a deep dive into how Moniepoint is helping her and other women entrepreneurs overcome their funding challenges.

Startups

HeyFood, hello vindication

HeyFood, a food delivery startup that operates in Ibadan, Nigeria’s third largest city, says it is profitable.

The Y-Combinator-backed company didn’t say by how much, probably reserving that detail for its current and potential investors it is speaking to in its ongoing fundraising to expand to other states.

HeyFood’s report about being in the green is noteworthy for several reasons.

Firstly, it adds to a string of pleasant vindications for the food delivery sector. In 2023, we saw deep-pocketed food delivery companies like Jumia Food, and Bolt Food throw in their towels due to the inability to keep up with the aggressive marketing. Soon after, we began seeing food delivery startups report profitability one after the other.

In November 2023, YC-backed Chowdeck said it is profitable after fulfilment. Last week, YC-backed FoodCourt said it makes as much profit as a healthy restaurant—enough to sustain its operations.

HeyFood, says it loses no money from its operations.

We might have to check in on what is in the YC water, but until then, this poses two questions did predecessors quit the game too early after overestimating the challenges in the sectors? Or is the new player curving the ball differently?

In answering positively to the first question, one may argue that leapfrogging into food delivery requires a long growth curve and the big players got jaded prematurely—right before investment into changing customer behaviours paid off. Now, tens of thousands of Nigerians make orders online monthly even with the last of their meagre pay. The average orders on HeyFood, Chowdeck and FoodCourt are ₦4,000 ($2.44) ₦7,000 ($4.27) and ₦15,000 ($9.14) respectively.

The answer to the second question may show that this is less about long-suffering and more about strategising.

HeyFood says that to 15x its revenue, it needs to expand to Abuja and Benin, instead of Lagos. HeyFood says that this is the strategy of Doordash, a U.S. company that grew market share by capturing suburban cities before moving into metropolitan ones. This is a more cost-efficient strategy that will allow the startup to piggyback on the popularity of local lucrative restaurants that sell food at true value, instead of restaurant chains that have trained their customers on discounts (fancifully named value-pack meals.) This is the opposite of what predecessors like Jumia did.

Whatever the true answers to these questions are, only time will tell.

Issue USD and Euro accounts with Fincra

Whether you run an online marketplace, a remittance fintech, a payroll, a freelance platform or a cross-border payment app, Fincra’s multicurrency account API allows you to instantly create accounts in USD and EUR for customers without the stress of setting up a local account. Get started today.

Economy

South Africa cuts back on interest rate as inflation cools

After ten consecutive hikes followed by a year of keeping the rate unchanged, the South African Reserve Bank has cut interest rates by 25 basis points. On Tuesday, the bank lowered interest rates from 8.25% to 8%.

For observers of Africa’s most industrialised economy, the decision was expected. Per SARB’s inflation update on Wednesday, South Africa’s inflation eased to 4.4% after a decrease in transport prices and utility rates. It is the lowest inflation rate since April 2021.

“In the analysis, we found 25 to be a prudent stance to take. You’ve got to be cautious. Adventurism is not part of our monetary policy toolkit,” SARB governor Lesetja Kganyago told a media briefing. Kganyago added that both 25 and 50 basis points cuts were “on the table” but the monetary policy committee unanimously settled on the former.

Second, although South Africa’s economy has seen growth since Q2 2024, driven by improvement in electricity supply and positive market sentiments after the formation of the government of national unity, the growth was marginal. According to SARB, it was 0.4% in Q2 2024, creating a need to boost economic activity by increasing money supply.

Most economists are of the view that the central bank will keep gradually cutting rates until at least May 2025. With three MPC sittings in that period and an assumed 25 basis point cut at each, the interest rate will be 7.25% by then, the lowest since pre-Covid. Inflation is also projected to abate in that period, which will further motivate cuts.

Introducing Pay with Pocket on Paystack Checkout

Paystack merchants in Nigeria can now accept payments from PocketApp’s 2 million+ customers. Learn more →

Insights

Funding Tracker

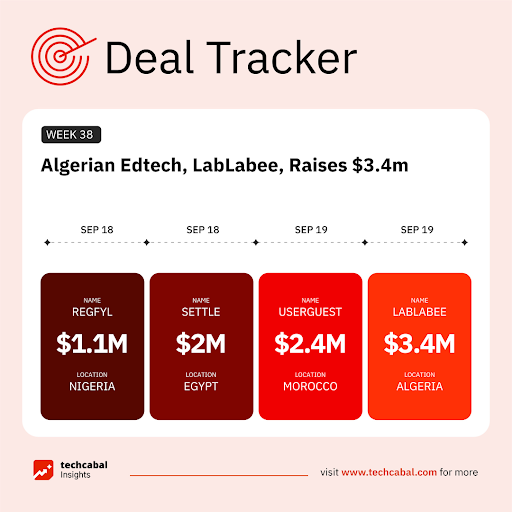

This week, LabLabee, an Algerian ed-tech platform, raised $3.4 million in its seed funding round. Reach Capital led the round, with participation from Classera, Brighteye Ventures, e& Capital and other angel investors. (September 19)

Here are other deals for the week:

- Moroccan travel SaaS startup Userguest closed a $2.4 million seed funding round. The round was led by Al Mada Ventures and featured CDG Invest, Saviu Ventures, UM6P Ventures, Kalys VC, Plug & Play, and business angels Philippe Limes and Thane Kuhlman. (September 19)

- SETTLE, an Egypt-based B2B payment platform, secured $2 million in a pre-seed funding round led by Shorooq Partners with participation from other investors, including El Sewedy Capital Holding, Acasia Ventures, and Plus VC. (September 18)

- Regfyl, a Nigerian regulatory tech startup, secured $1.1 million in pre-seed funding. The funding came from Techstars, RallyCap Ventures, DCG Expeditions, Africa Fintech Collective, Musha Ventures, and several strategic angel investors. (September 18)

- Foodpreneurs Hub, a Nigerian-founded food-tech platform, raised $500,000 in pre-seed funding. The company didn’t name the investors in the round. (September 19)

- Farid, an Egyptian ed-tech startup, received $250,000 in pre-seed funding from Saudi entrepreneur Amal bint Abdulaziz Al-Ajlan. (September 18)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, our State of Tech in Africa H1 2024 Report is out. Click this link to download it.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $62,860 |

+ 1.22% |

+ 6.13% |

|

| $2,458 |

+ 3.00% |

– 4.83% |

|

|

$2.81 |

– 20.94% |

– 20.45% |

|

| $142.89 |

+ 5.89% |

+ 0.02% |

* Data as of 01:30 AM WAT, September 20, 2024.

Events

- Catalysing Conversations by Endeavor Nigeria, which brings together Nigeria’s most exciting high-impact entrepreneurs, influential business leaders, and forward-thinking policymakers for inspiration, learning, and networking, is one of the highlights of the Endeavor events calendar. With a projected attendance of 500 curated in-person guests and over 500 virtual audience members, this event promises to be a remarkable gathering of innovation and collaboration. Register here.

- Difficulties within Africa’s economic landscape have raised questions about the feasibility of building successful startups on the continent. Iyin Aboyeji, a Nigerian entrepreneur who co-founded two companies valued at over $1 billion before the age of 30, is now a prominent startup investor. He is one of the featured speakers at Moonshot 2024, joining other innovators and industry leaders working on groundbreaking solutions to Africa’s most pressing challenges. Save your seat at Moonshot! Get tickets here.

- Step into the Future with AWS Community Day West Africa 2024! Are you ready to be part of the revolution shaping the next era of tech? Join the trailblazers, visionaries, and innovators who are pushing the boundaries of what’s possible. This is your chance to connect, learn, and ignite your passion alongside the brightest minds in the industry. Don’t just witness the future—be a part of it on September 27th & 28th. Register today.

Issue virtual USD cards for you and your customers

Do you want to issue virtual USD cards for your customers and business expenses? Use Kora’s APIs to issue cards, customise your card program, and set your customers’ funding limit to your risk level. Get started here.

Written by:Ngozi Chukwu, Ephraim Modise, Stephen Agwaibor and Emmanuel Nwosu

Edited by: Olumuyiwa Olowogboyega & Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

Read Next

Read more