In partnership with

Good morning ☀️

Start your new week on a light note. For the next few days, we’re offering TC Daily readers 20% off tickets to Moonshot 2024.

All you have to do is enter the coupon code “MSTCD” for local tickets, and “MSTCD1” for international tickets.

Internet

Elon Musk holds talks with South Africa’s Ramaphosa over Starlink

Starlink could be only weeks away from getting regulatory approval in South Africa.

Founder Elon Musk is now in talks with President Cyril Ramaphosa to bring the satellite internet service provider (ISP) to the country.

Since Starlink began its march into African markets in 2022, most southern African countries have been tough nuts for it to crack. In Botswana for example, where it recently got licenced, it had its licence application blocked for more than six months. In Zimbabwe, Starlink can only operate through agents, dealers, and ISPs that the government must clear.

South Africa’s own laws require that foreign companies cede 30% of their ownership to historically disadvantaged groups (like marginalised people of colour and women.) But that has always been a fool’s errand because as a privately-held company, there is likely reluctance from Starlink or SpaceX, its parent company, to meet this requirement.

Now, post-meeting, Ramaphosa is singing a new tune, calling for Musk to invest in the country:

“I have had discussions with him and have said, Elon, you have become so successful and you’re investing in a variety of countries. I want you to come home and invest here.”

With South Africa’s broadband issues driving up the demand for Starlink in the country, there is an opportunity here for Musk’s high-speed internet. Its entry into South Africa could shake up the ISP market dominated by companies like Telkom, MTN, and Vodacom.

It’s the win South Africans are looking for, but regulators are not budging yet. Who knows? Ramaphosa’s new endorsement could be key for Musk.

Read Moniepoint’s 2024 Informal Economy Report

Did you know that 57.7% of the business owners in Nigeria’s informal economy are under 34 years old? Click here to find out more about the demographics of Nigeria’s informal economy.

Banking

Sterling Bank’s big bet on custom banking system

Sterling Bank, a Nigerian bank, is doing something unique: it’s building its own core banking system. This is like a bank deciding to build its own car factory instead of buying cars from a dealership. It’s a massive, expensive, and risky undertaking, but it could also be a huge advantage for the bank.

In banking, most institutions buy their core banking systems off the shelf. It’s easier, and faster, but it also comes with some significant downsides.

For starters, when you buy a pre-built core banking system, you’re at the mercy of the vendor. And if you need to make changes to the system, you’re going to have to pay for it.

On the other hand, building your own core banking system, like Sterling’s, gives you complete control. You can customise it to do exactly what you want, without having to worry about the limitations of a pre-built system. And if you need to make changes, you can do it yourself, without having to pay a vendor.

But building your own core banking system is a lot of work. It’s expensive, time-consuming, and risky.

And if you screw up, it could be a disaster. Studies have shown that the total cost of ownership (TCO) for a custom-built system can be higher than that of a purchased solution. The TCO of a custom-built core banking system can be 20-30% higher than that of a purchased solution.

While the custom banking system has been explored in other parts of the world, Sterling Bank is among the first African banks to implement the solution.

So, is this move worth it for Sterling? Only time will tell whether Sterling Bank’s gamble will pay off. But one thing is for sure: they’re making a big bet on the future of Nigerian banking.

Fincra secures International Money Transfer Operator (IMTO) licence in Nigeria

Since its inception, Fincra has provided businesses with local payment options. However, with the IMTO licence, Fincra can now manage funds transfers from abroad to Nigerian recipients more efficiently. Read more here.

Inflation

Experts expect a tempered inflation rate in Nigeria

In July, Nigeria’s inflation slowed for the first time in two years—33.4%—in almost two years.

Nigeria Bureau of Statistics will release inflation figures for August today. Analysts are divided on their predictions. While some expect a slow in inflation, others expect higher interest rates, while others expect the inflation rate to be steady.

Analysts from Stears and Norrenberger predict that the country’s inflation could slow for the second consecutive month, with predictions of 32.05% and 32.4% respectively. This thinking is rooted in the positive impact of the harvest season. Food prices which make up a bulk of the consumer price index eased in July. Some analysts expect this trend to continue in the new month.

Given the recent surge in fuel costs, analysts are anticipating either a flat interest rate or a rate increase. Egypt, last month, recorded an increase in its inflation rate after it raised prices of fuel products by 15%.

While analysts might be divided in their opinion about Nigeria’s August inflation rate, they all agree on one thing. The recent increase in fuel prices will significantly drive up the inflation rate in the coming months.

Psst 👀 Here’s Paystack Developer Contributor of the month

Microsoft Engineer Ekene Ashinze built the Angular Paystack Library, a module that helps developers accept payments in their Angular apps with Paystack. Discover his journey in creating the library and how it’s opened doors for him both locally and globally. Learn more →

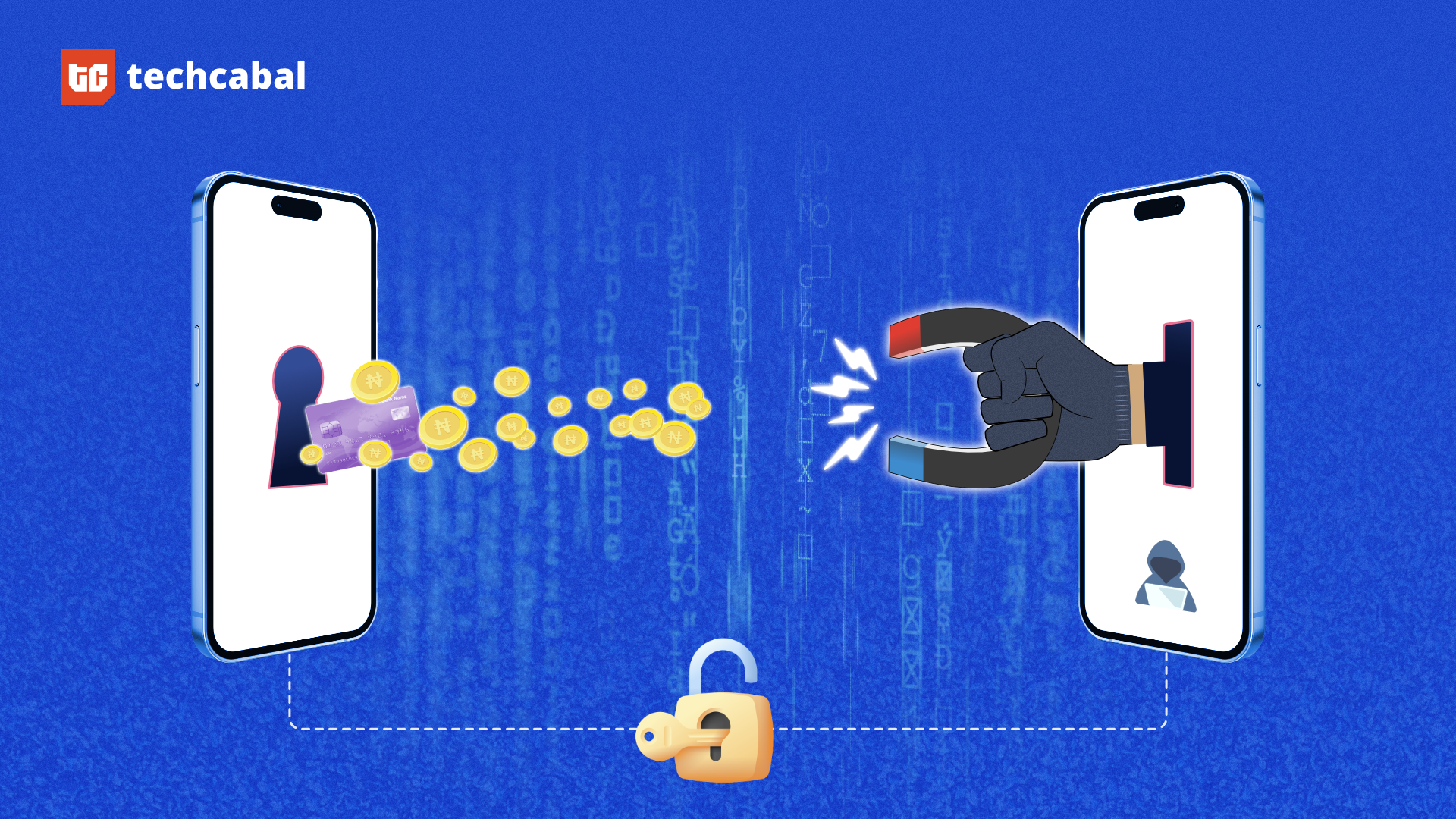

Cybersecurity

Nigerian Banks lose $25.7 million to fraud in Q2 2024

Smaller fraud cases, bigger cash targets. In Nigeria, fraudsters may be starting to “think small” in their approach.

The Financial Institutions Training Centre (FITC), a Nigerian financial training and research centre, has reported a significant rise in fraud losses across the country’s banking sector in Q2 2024.

In its recently released Fraud and Forgeries Report, FITC reported that fraud cases in Nigerian banks increased only slightly in Q2 2024, with 11,532 incidents compared to Q1’s 11,472. Yet, there was a massive jump in the amount lost to fraud from ₦468 million ($283,000) in Q1 2024 to ₦42.6 billion ($25.7 million) in Q2 2024.

Fraud has been a recurring problem in the Nigerian banking sector. When separate Q1 reports from both FITC and Nigeria Interbank Settlement Scheme (NIBSS), the country’s payments switch, showed that fraud cases slowed in Q1, there was a sense that the country was finally on track to cure this broken part of the system.

Another area of growing concern is the involvement of banking staff. Banking insiders were involved in 58 of these fraud cases, and about 49 staff appointments were terminated in Q2 2024; most of these involved fraudulent withdrawals and two cash theft cases.

Nigeria’s central bank has been hard at work implementing stricter know-your-customer (KYC) policies for fintechs and digital banks.

Yet, digital channels like computer/web, mobile banking, and POS terminals remain top three targets for fraud, with cases in these areas steadily rising.

Though the Central Bank’s regulatory efforts have made progress, insider involvement and digital vulnerabilities continue to plague the banking sector, undermining efforts to curb fraud completely.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $58,536 |

– 2.73% |

– 1.16% |

|

| $2,289 |

– 5.53% |

– 12.04% |

|

|

$0.78 |

+ 20.25% |

+ 170.83% |

|

| $130.93 |

– 4.42% |

– 5.97% |

* Data as of 06:20 AM WAT, September 16, 2024.

Events

- Catalysing Conversations by Endeavor Nigeria, which brings together Nigeria’s most exciting high-impact entrepreneurs, influential business leaders, and forward-thinking policymakers for inspiration, learning, and networking, is one of the highlights of the Endeavor events calendar. With a projected attendance of 500 curated in-person guests and over 500 virtual audience members, this event promises to be a remarkable gathering of innovation and collaboration. Register here.

- Selar, Africa’s largest creator platform, is hosting its third annual Creator Summit, themed “Living The Pan-African Dream as a Creator.” Taking place on September 20th and 21st, 2024, the program will feature top African creators, actors, and media personalities, including Big Cabal Media’s Tomiwa Aladekomo, Moe Odele, Tunde Onakoya, and more. They will discuss topics about content monetisation and digital entrepreneurship to empower African creators to build sustainable careers in the global marketplace. Apply here to attend.

- Step into the Future with AWS Community Day West Africa 2024! Are you ready to be part of the revolution shaping the next era of tech? Join the trailblazers, visionaries, and innovators who are pushing the boundaries of what’s possible. This is your chance to connect, learn, and ignite your passion alongside the brightest minds in the industry. Don’t just witness the future—be a part of it on September 27th & 28th. Register today.

Issue virtual USD cards for you and your customers

Do you want to issue virtual USD cards for your customers and business expenses? Use Kora’s APIs to issue cards, customise your card program, and set your customers’ funding limit to your risk level. Get started here.

Written by: Faith Omoniyi, & Emmanuel Nwosu

Edited by:Olumuyiwa Olowogboyega & Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

Read Next

Read more