In partnership with

Good morning ☀️

If you want to dive into the future of African tech, then Moonshot 2024 is where you want to be.

Connect with industry pioneers, explore emerging trends, and discover untapped business opportunities in one of the world’s most dynamic markets.

Enjoy the vibrant energy of Lagos while staying seamlessly connected with prepaid eSIMs from Sochitel. Register now for two days of inspiration, networking, and innovation.

M&As

Risevest completes Hisa acquisition

While Nigeria’s Access Bank is easily the busiest M&A machine in the financial services space, fintech startup Risevest isn’t doing badly either. Two months after we first reported that it was in talks to buy the Kenyan fintech startup Hisa, the deal has officially closed. It’s Risevest’s second acquisition in a little under a year.

Anatomy of the deal: Risevest and Hisa are fintech startups allowing a growing class of African retail investors access to global stocks and other investment options like real estate. An acquisition of Hisa, which has been approved by Kenya’s markets authority, allows Risevest to expand to Kenya without any hassle. Without this acquisition, getting a licence to operate a fintech in Kenya may have taken up to two years.

How much did this deal cost? Risevest and Hisa prefer not to say, although one person with direct knowledge of the deal said it was a cash and stock deal. While a 2022 fund raise valued Hisa at $5 million, it’s doubtful that it would have sold for anywhere near that price. Watch out for Kenn’s article on why this deal made sense for Hisa.

A nose for a deal? Risevest acquired Nigerian fintech Chaka in September 2023—it also declined to share the specifics of that deal. That deal made sense because it allowed Risevest to expand its slew of licences, said one person familiar with the deal. Chaka for instance, offered Nigerian stocks and was one of the first companies to receive a digital sub-broker licence from the Securities and Exchange Commission (SEC).

Given that both companies’ investors were interested in making the 2023 deal happen, it is likely to have been a stock-only deal.

Will we continue to see savvy dealmaking from Risevest as it adds more infinity stones spots more opportunities? Its CEO artfully sidestepped that question.

However, he spoke to us on what the future holds for Hisa under new ownership.

Read about it here.

Read Moniepoint’s 2024 Informal Economy Report

Did you know that 57.7% of the business owners in Nigeria’s informal economy are under 34 years old? Click here to find out more about the demographics of Nigeria’s informal economy.

Banking

How cost considerations are driving shrewd banking business in Nigeria

How do the rich stay rich? By shrewdly keeping an eye on costs and ruthlessly pruning anything that may become a drag on their finances later.

That’s the story of Nigeria’s biggest commercial banks which reported a combined ₦9.51 trillion ($5.7 million) in profits in 2023. Some tier-1 banks briefly hit ₦1 trillion (($608 million) in market capitalisation despite Nigeria’s macroeconomic conditions.

Nigeria’s big banks have perfected the art of eking out profits regardless of the economic conditions and USD-denominated costs are the current enemy of that goal. The decision to float the naira has significantly increased technology costs; think storage, software licencing and even hardware.

While banks are notoriously conservative businesses, we’re seeing some flexibility in how they’re thinking about technology costs. On Monday, Sterling Bank formally announced its move to SeaBaaS, a new core banking application. One person suggested that cost consideration may have played a part in the decision to have its custom software.

Beyond software, local cloud players are also finding joy pitching to companies. With more competitive pricing than AWS or Azure, big organisations are trying new entities.

Huawei, the Chinese enterprise company that went from upstart to a dominant player in the telecoms market, is also seeing and taking opportunities in the Nigerian banking space.

Here’s an excerpt from a TechCabal story about how Huawei sold some storage to United Bank for Africa (UBA), a tier-1 commercial bank;

“They lure customers in with the option of a free-to-use one-year solution,” said one cloud engineer at another tier-1 bank, citing Huawei’s extended proof of concept that allowed banks to use specific solutions for free.

“No one else will offer you a one-year proof of concept,” another cloud engineer said.

Read about it here.

Fincra secures International Money Transfer Operator (IMTO) licence in Nigeria

Since its inception, Fincra has provided businesses with local payment options. However, with the IMTO licence, Fincra can now manage funds transfers from abroad to Nigerian recipients more efficiently. Read more here.

Mobility

Are Ride-Hailing Platforms Broken? Drivers Say Yes

Kenyan and Nigerian gig drivers can trade places given how similar their challenges are. Two weeks after gig drivers in Kenya defied the almighty algorithms of Uber and Bolt to fix their own prices—that was always going to be shortlived for reasons I’ll explain later—Nigerian drivers are lightly copying the playbook.

One gig driver in Lagos shared that trips under ₦3,000 ($1.82) are not worth his time; drivers are now telling customers to pay extra or cancel the trips. On Monday, my colleagues in Abuja took four trips on Bolt and Uber for which they had to pay above the prescribed prices.

Is the gig driving model broken? Or are macroeconomic conditions spotlighting problems in a fragile business model? These questions are crucial as the gig economy faces increasing tensions between drivers and ride-hailing companies. Drivers in Kenya and Nigeria are protesting low fares, rising costs, and the perceived unfairness of the platform algorithms.

Bolt and Uber increased fare prices by 13% and 15% respectively in Nigeria. One gig driver in Lagos told me that those price increments do not match the extra costs he has to pay for fuel. That driver’s sentiment is echoed in Kenya where drivers want a minimum base fare of KES300 ($2.33).

Psst 👀 Here’s Paystack Developer Contributor of the month

Microsoft Engineer Ekene Ashinze built the Angular Paystack Library, a module that helps developers accept payments in their Angular apps with Paystack. Discover his journey in creating the library and how it’s opened doors for him both locally and globally. Learn more →

Economy

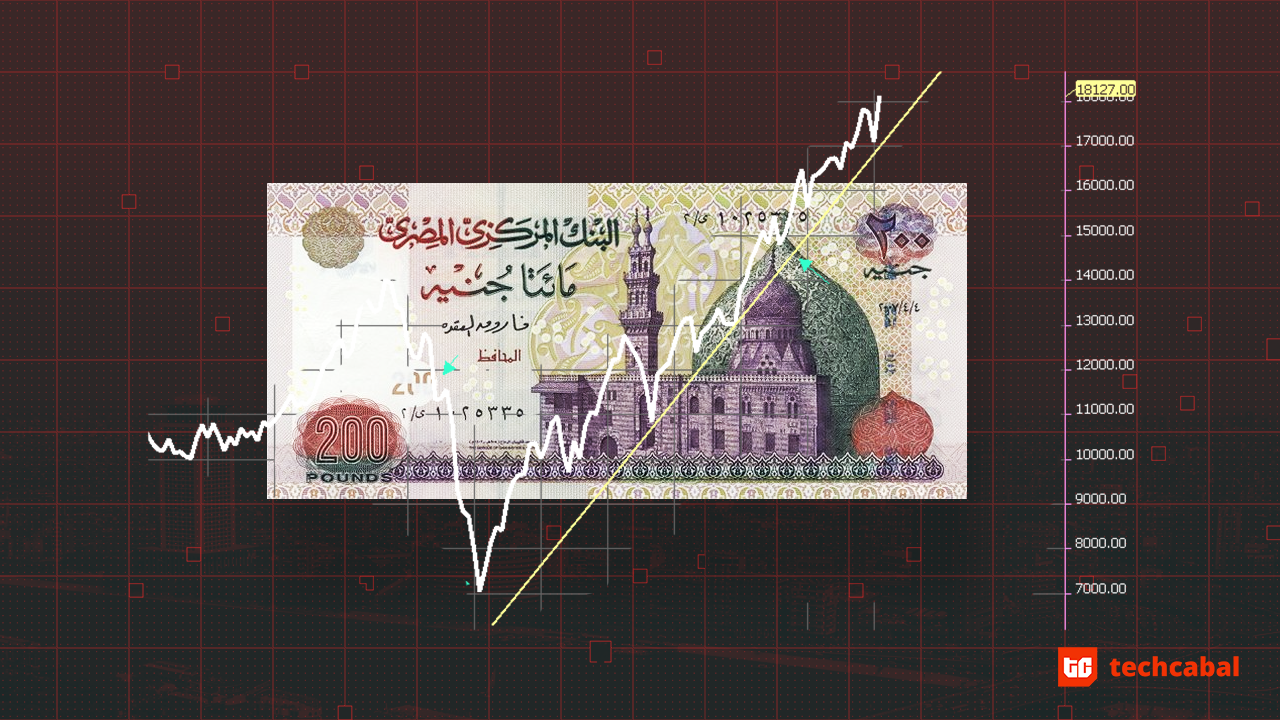

Egypt’s inflation soars first time in five months

Since February, the inflation rate in Egypt has been on a downward trend.

Inflation eased from 35.1% in February to about 25.7% in July. This trend encouraged hopes of the first interest rate cut since 2020 and had analysts predicting a further drop in the inflation rate to about 21% by year-end.

However, inflation figures for August may have bucked that trend. According to Egypt’s Central Agency for Public Mobilization and Statistics (CAPMAS), inflation rose to 26.2% in August up from 25.7% in July.

This increase was a result of the impact of fuel hikes on consumer and business transportation costs and an increase in electricity tariffs. Last month, Egypt raised prices of fuel products by 15% after it agreed with the International Monetary Fund to drop fuel subsidies. Food prices which constitute a bulk of the consumer price index also rose by 1.8%.

While August figures are the highest in five months, analysts believe that it’s a temporary bump in the path to lower inflation. Analysts are optimistic of a return to a disinflation trend.

The recent hike in fuel prices in Nigeria—whose inflation, last month, slowed for the first time in two years—may see the country experience the same inflationary pattern as Egypt. Analysts expect the recent increase in fuel prices to drive an increase in September’s inflation rate. The country will announce the August inflation rate next week.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $56,288 |

– 1.32% |

– 3.88% |

|

| $2,321 |

– 1.07% |

– 8.63% |

|

|

$0.28 |

– 11.77% |

+ 331.26% |

|

| $131.79 |

– 1.37% |

– 8.31% |

* Data as of 06:30 AM WAT, September 11, 2024.

Events

- Inside the big stories transforming the Arabian Peninsula and the world. Introducing Semafor Gulf – your go-to source for understanding the rising influence of Saudi Arabia, the UAE, and Qatar. Three times a week, the Semafor Gulf newsroom will bring you original reporting that examines how the region’s financial, business, and geopolitical decisions shape the world, from culture and investment to infrastructure, climate, and technology. Navigate the region’s capital, influence, and power with Semafor Gulf – subscribe for free here.

- The Lagos Innovates Workspace Voucher Programme is back, offering startups the chance to secure state-of-the-art workspaces with top-notch equipment, all without the usual costs. Benefit from a collaborative environment, networking opportunities, and the freedom to focus on building your dream startup. Apply for a workspace voucher.

- Lagos Idea Hub is an 8-week program designed for entrepreneurs ready to scale their startups with tailored mentorship, proven growth strategies, and direct access to industry experts. Gain practical insights from mentors who understand your industry, implement strategies that drive sustainable growth, and connect with a powerful network of entrepreneurs, investors, and leaders. Apply to join the Cohort 10.0.

- Resilience17 (R17) is launching an AI Accelerator to help ambitious globally focused teams, build and launch AI products. The Go Time AI Accelerator is open to Nigeria-based companies. The accelerator offers up to $200k total investment with an initial $25k upfront (via SAFES with a $2.5m valuation cap), expert mentorship from industry veterans and technical gurus, technical and business growth support, access to API & Cloud credits, housing credits, delicious team meals, and a vibrant workspace in Victoria Island, Lagos. Apply by September 13.

Issue virtual USD cards for you and your customers

Do you want to issue virtual USD cards for your customers and business expenses? Use Kora’s APIs to issue cards, customise your card program, and set your customers’ funding limit to your risk level. Get started here.

Written by: Olumuyiwa Olowogboyega, Faith Omoniyi & Emmanuel Nwosu

Edited by: Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

Read Next

Read more