In partnership with

Fintech

Flutterwave inks deal with Amex as it continues its move to Africa

When a global giant like American Express knocks on your door, it’s rarely a social visit. The credit card behemoth’s interest in Africa is simple: as droves of US and European customers travel to the continent for leisure, the global credit card leader sees an opportunity to extend its reach and cement its position as a preferred choice of payment for these travellers.

The credit card giant has been signing deals with payment processors and banks across Africa to help it gain acceptance in more countries. It signed a deal with Ecobank in May to help push its card adoption to 47 countries in Africa up from 35.

Yesterday, Nigerian fintech giant, Flutterwave announced a deal with the company. The partnership will allow Nigerian merchants to receive payments from American Express card customers. The fintech will extend the service to merchants in other African markets, including Tanzania, Rwanda, Ghana, and Uganda.

As Amex makes inroads into the continent, it will slug it out with Visa and Mastercard who own a significant market share. The company’s strategy is to lure hoteliers, restaurants, and tourism destinations across Africa to accept its cards. The company has set an ambitious target of having at least 75% of merchants in a country accepting its card for payment.

Read Moniepoint’s 2024 Informal Economy Report

Did you know that 57.7% of the business owners in Nigeria’s informal economy are under 34 years old? Click here to find out more about the demographics of Nigeria’s informal economy.

Fintech

Zone partners with NIBSS

When we sat down with Obi Emetarom, Zone’s CEO, for an interview ahead of its partnership announcement with the Nigeria Inter-Bank Settlement Scheme (NIBSS), we got curious about how the company pulled off the blockchain partnership with a major regulator. We asked, “How did you do it?”

Openness to collaboration. That was one answer. Over the years, NIBSS has been very experimental with how it expands its impact on Nigeria’s digital payments, and Zone was able to tap into that.

Another likely answer is that Zone is a regulated, custom-built blockchain. Whatever primary data passes through it remains well within the regulatory oversight of Nigeria’s central bank; thanks also to the switching licence it operates.

Zone’s blockchain nodes will allow banks to perform switching functions and communicate directly. A technology like this, and NIBSS’s access as a Payment Terminal Service Aggregator (PTSA) will solve chargeback fraud, and Emetarom is betting on it.

Its partnership with NIBSS will now allow Zone to record POS transactions on a blockchain ledger open to all financial institutions in the ecosystem, thus making failed transaction settlements faster.

There’s more about the partnership here.

Collect payments anytime anywhere with Fincra

Are you dealing with the complexities of collecting payments from your customers? Fincra’s payment gateway makes it easy to accept payments via cards, bank transfers, virtual accounts and mobile money. What’s more? You get to save money on fees when you use Fincra. Get started now.

Layoffs

IHS lays off 100 senior employees

When a company is facing mounting losses, one of the most drastic measures it can take is to reduce some of its largest expenses. For IHS Towers, like many other companies, that meant cutting staff.

The company has been grappling with mounting losses, largely due to the devaluation of the Nigerian naira, its primary market. It incurred a loss of $409 million in the fourth quarter of 2023 after a currency devaluation in Nigeria reduced revenues and increased foreign exchange losses on dollar-denominated loans. In the first quarter of 2024, the business spent $88.8 million on power, its largest operating cost.

To mitigate these losses and extend its financial runway, IHS Towers has made the difficult decision to

lay off some members of its senior staff, most of whom have spent over a decade at the company. The affected employees received “significant” severance packages, according to one insider.

By reducing its payroll in this way, IHS Towers, which currently employs 1,600 people, hopes to improve its financial health and position itself for future growth.

Paystack Virtual Terminal is now live in more countries

Paystack Virtual Terminalhelps businesses accept secure, in-person payments with real-time WhatsApp confirmations and ZERO hardware costs. Enjoy multiple in-person payment channels, easy end-of-day reconciliation, and more. Learn more on the Paystack blog →

Mobility

Uber Kenya raises fare prices, drivers not impressed

Kenyan gig drivers have been protesting against ride-hailing apps like Uber and Bolt since July. Their demands: make KES300 ($2.33) the minimum ride fare, remove VAT tax, and lower the commission fees.

These drivers have been rebelling since to force the hand of these apps, setting their own prices and going off-routes. They say that the high commissions they’re paying won’t cut it anymore, given the rising price of operating a ride-hailing business in Kenya. What used to be a decent earning opportunity for these informal workers no longer looks the same.

Yesterday, it appeared one of these apps, Uber Kenya, heard their cries and increased its base fare to KES220 ($1.71) and added another opportunity for drivers to earn more with a service that will charge an additional KES110 ($0.85) for a shorter wait time.

But drivers are not satisfied with this. “They’ve not gotten to 10% of our demands. We will be back at it again,” said Zakaria Mwangi, the Secretary General of Ridehail Transport Association (RTA).

The situation just as well puts ride-hailing apps in a pickle: drivers are demanding increased fares, but they cannot pass this off to customers so they don’t lose them. They do not want to self-sabotage with cheaper matatu buses and other public transport systems lurking to steal back customers.

And these ride-hailing apps are not willing to bet on their ability to make switching costs expensive for their customers either. So the default move goes something like this: drivers protest, the apps reduce their fees and increase fares, blow off steam and make the drivers happy. It might be doing the same again. Rinse and repeat.

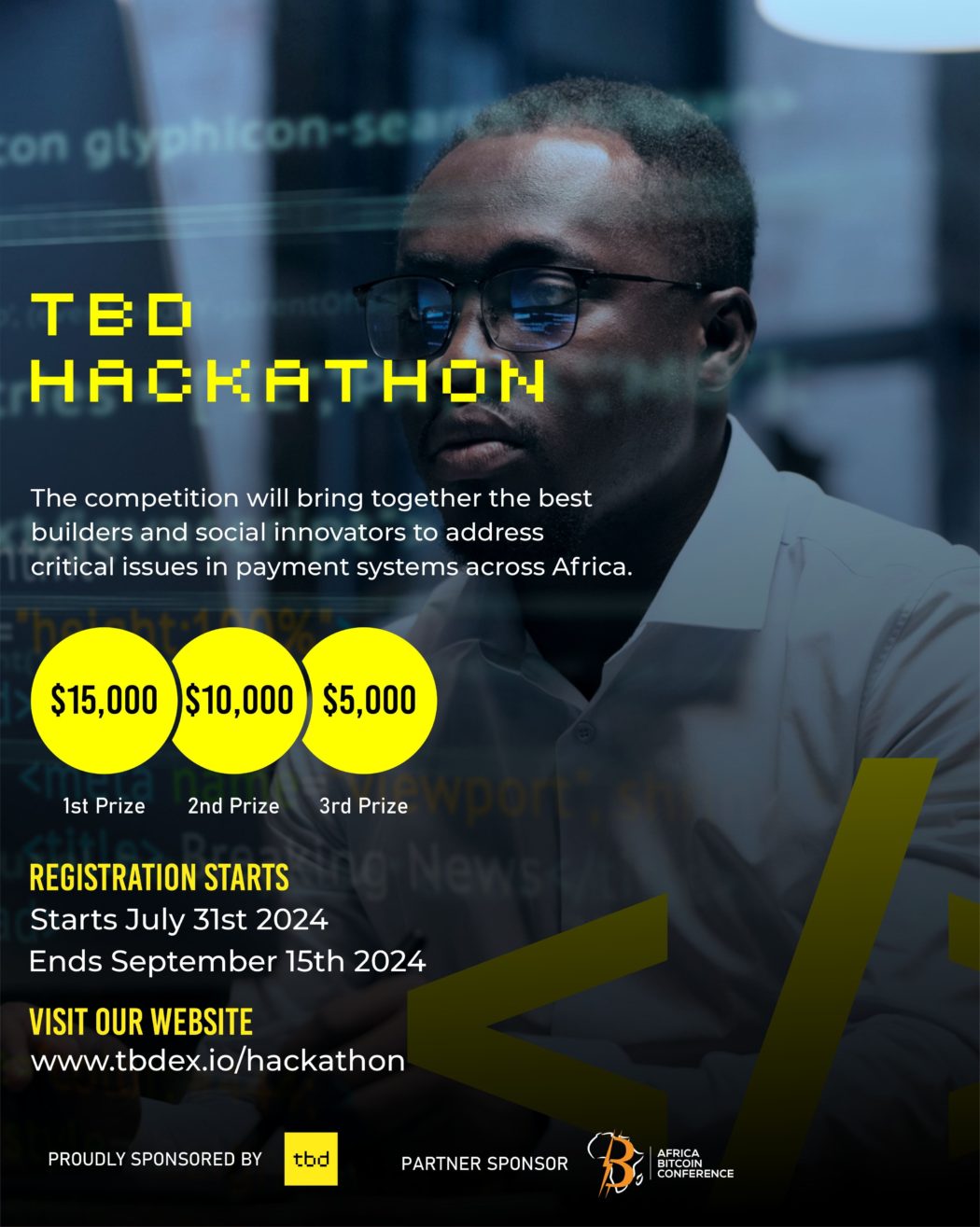

Win big in the TBD Hackathon

Calling all African innovators! Join the TBD Hackathon and revolutionise payment solutions in Africa. Do you have a passion for building solutions and shaping the future of finance? Build a payment app with tbDEX & win up to $15,000 in BTC! Apply by Sept 15

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $59,394 |

– 2.57% |

– 11.47% |

|

| $2,591 |

– 2.87% |

– 26.15% |

|

|

$0.14 |

+ 11.13% |

+ 16.88% |

|

| $142.61 |

– 2.75% |

– 21.35% |

* Data as of 05:55 AM WAT, August 21, 2024.

Events

- Difficulties within Africa’s economic landscape have raised questions about the feasibility of building successful startups on the continent. Iyin Aboyeji, a Nigerian entrepreneur who co-founded two companies valued at over $1 billion before the age of 30, is now a prominent startup investor. He is one of the featured speakers at Moonshot 2024, joining other innovators and industry leaders working on groundbreaking solutions to Africa’s most pressing challenges. Save your seat at Moonshot! Get tickets here.

- Take part in a transformative journey where innovation and technology meets agriculture. The FCMB Agritech Hackathon, holding from September 17–20, is your platform to innovate, collaborate, and make a real impact on the future of agriculture in Nigeria and Africa. Registered startups, SMEs and developers in the agritech sector are invited to register for a chance to win up to ₦23 million ($15,000) in prizes. Apply by September 5.

- Step into the Future with AWS Community Day West Africa 2024! Are you ready to be part of the revolution shaping the next era of tech? Join the trailblazers, visionaries, and innovators who are pushing the boundaries of what’s possible. This is your chance to connect, learn, and ignite your passion alongside the brightest minds in the industry. Don’t just witness the future—be a part of it on September 27th & 28th. Register today.

Written by: Faith Omoniyi & Emmanuel Nwosu

Edited by: Olumuyiwa Olowogboyega & Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

Read Next

Read more